After all, what changes were made to the IRS? Do you know how much (if and from when) you will receive more? A lawyer did the math.

The most recent amendments to the Personal Income Tax Code will have a significant impact on taxpayers and families starting next year, when filing the 2024 tax return. It is important to note the main tax implications of these changes and how much families can save.

What changes have been made to the tax rate table applicable to each IRS bracket?

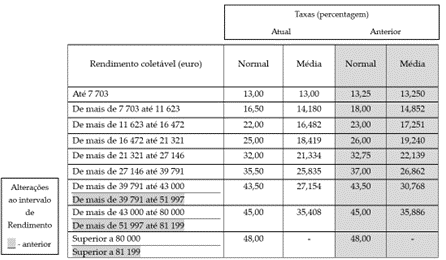

The new table provides for a reduction in the rates applicable to the first six IRS brackets. Additionally, from the seventh bracket onwards, the income ranges to which the rates apply have been updated. Let's see, according to the table below, the changes introduced, comparing the rates and income ranges applied until the entry into force of the new Law in August of this year:

Which tax brackets will benefit the most from these changes?

The second bracket, with a new standard rate of 16.50% compared to the previous rate of 18.00%, along with the sixth bracket, which now has a standard rate of 35.50% compared to the previous rate of 37%, are the brackets where the decrease is most noticeable, amounting to 1.5 percentage points.

Will all taxpayers benefit from these changes?

All taxpayers will benefit from the tax rate reduction, regardless of the fact that the reduction was only made up to the sixth bracket. This is because income tax is a progressive tax, which means that even if the bracket applicable to the taxable income is one of the highest, which did not see its rate reduced, the taxpayer will benefit from this measure, since, for the calculation of the tax, the income can be divided according to the various brackets and each portion of income can be introduced into the corresponding bracket, being taxed less, until the final bracket is reached or, in other words, the portion to be deducted from the taxable income is higher. This portion is automatically deducted from the taxable income when calculating the tax, by the competent services.

What impact will the changes in the income ranges have on the highest brackets?

On the other hand, although the changes benefit all taxpayers, there is a set of incomes, between €43,000.00 and €51,997.00, which in the previous table were included in the seventh bracket and which, with the changes, will now be taxed by the eighth bracket. The same applies to the last two income brackets, where the seventh bracket now only includes taxpayers with taxable income up to €80,000.00, instead of the previous value of €81,199.00. Thus, only taxpayers in the last bracket are subject to the additional 2.5%, corresponding to the solidarity additional tax, which applies to the excess income over €80,000.00.

Are there any other relevant changes?

Yes, the specific deduction has been increased by 6%. When calculating the taxable income up to 2023, the amount of €4,104.00 was deducted from the annual gross income; with the 6% increase in this value, directly related to the increase in the Social Support Index, a specific deduction of €4,350.24 is now made. This change translates into a saving of €246.24 that will not be subject to taxation. It is important to mention here that the specific deduction applies equally to all taxpayers who receive income from category A - Dependent employment income. For pensioners, with income from category H, this amount has also been updated, and it is now possible to deduct up to €4,350.24, instead of the previous value of €4,104.00.

When will taxpayers start seeing the tax benefits?

These changes will take effect in the future, meaning that taxpayers will only feel the effects in 2025 when filing their 2024 tax return. However, if new withholding tax tables are approved this year, taxpayers may see changes sooner.

Let's look at an example to consolidate the changes:

Single person, 40 years old:

- Earns an annual amount of €21,000, corresponding to €1,500 per month, from category A income, multiplied by fourteen months.

- During the year, they spent €1,000 on health, €7,200 on rent, and €2,000 on education, attending a postgraduate course.

Tax calculation:

- Determine the annual gross income: €21,000

- Determine the taxable income, deducting the specific deduction: €21,000 - €4,350.24 = €16,649.76

- Determine the IRS bracket: Fourth bracket - From more than 16,472 to 21,321

- Apply the rate, subtracting the amount to be deducted: €649.76 x Standard rate of 25% - amount to be deducted of €1,403.03 = €2,761.41

Note that the calculation method presented is the simplest, used by the Tax and Customs Authority in calculating the tax. However, there are other methods, such as allocating to each bracket the corresponding value up to the maximum bracket to which the income corresponds.

- Obtain the total tax: €2,761.41

- Calculate the tax after deductions, noting that there is a maximum deduction limit:

Health: €1,000 x 15% = €150 (the maximum deduction is 15% of expenses up to €1,000 per household)

Rent: €502 (the maximum deduction is 15% of the value of rents up to €502 per household)

Education: €2,000 x 15% = €300 (the maximum deduction is 15% of expenses up to €800 per household)

Total: €2,761.41 - (€150 + €502 + €300) = €1,809.41

- Verify if the limit of the sum of the deductions to the tax has been exceeded:

Bracket: fourth bracket

Sum of deductions: €952 Limit: between the second and eighth brackets, the limit varies between €1,000 and €2,500

Exact value in the specific case:

€1,000 + [(€2,500 - €1,000) x (€80,000 - €1,809.41) / (€80,000 - €7,703.00)] = €2,418.48

Conclusion: the limit has not been exceeded, the deductions do not need to be reduced

- Obtain net tax: €1,809.41

- Subtract withholding tax:

According to the Withholding Tax Table for Continental Portugal - Table I - Dependent work - Single without dependents or married two holders - the withholding tax is calculated as follows:

(Remuneration of €1,500 x 25% rate) - €186.66 (amount to be deducted) = €188.34 per month €188.34 x 14 months = €2,636.76 annual withholding tax

- Determine the final tax: €1,809.41 - €2,636.79 = -€827.35

- Conclusion: this taxpayer is entitled to a refund of €827.35 in IRS.

How would the calculations be with the previous table?

With the same reference values, and considering, for the sake of simplifying calculations, only the withholding tax table used in the second half of 2023, the taxpayer would be entitled to a refund of €678.22 in IRS.

Thus, for this taxpayer, the update represents a gain of €149.13.